arizona maricopa county tax lien

Welcome to the world of Maricopa County Arizonas Tax Liens. Furthermore some offices eg.

Arizona State Programs That Provide Property Tax Relief.

. Tax Liens by the Numbers. The Judicial Branch of Arizona. After a municipality issues a tax lien.

Assessor Gila County Assessor 1400 E. Tax liens can yield 18 over 6 months - thats 36 per year. Probate and Mental Health Department.

Gina Marie Rayner Reward. Search Gila County current property tax and assessment records by parcel number tax ID address or owner name. A tax lien in Arizona is a security interest placed on real estate because of unpaid taxes.

These parcels have been deeded to the State of Arizona as a result of a property owners failure to pay property taxes on the parcel for a number of years. Tax liens are involuntary and general because they are placed mainly on real. A number will be assigned to each bidder for use when purchasing tax liens through the Treasurers office and the online Tax Lien Sale.

Georgia is ranked 31st of the 50 states for property taxes as a percentage of median income. Satisfaction of Judgment and Release of Lien instructions and form CVSJ91p-f. Ash Street Globe AZ 85501 Phone 928402-8714 Fax 928425-0408.

In the Matter of the Estate of. The idea of paying taxes isnt necessarily a foreign concept especially for seniors who have been paying countless types of taxes their entire lives property taxes being one of them. Pursuant to Arizona Revised Statutes Title 42 Chapter 18 Article 3 Sections 42-18101 through 42-18126.

Maricopa County collects on average 059 of a propertys assessed fair market value as property tax. Fulton County collects the highest property tax in Georgia levying an average of 108 of median home value yearly in property taxes while Warren County has. SUPERIOR COURT OF ARIZONA.

More specifically the Supreme Court of the United States in United States v. These records can include Maricopa County property tax assessments and assessment challenges appraisals and income taxes. He was elected in November 2020 and took office January 2021.

First lets address growing property tax values. By signing this affidavit I we swear or affirm under penalty of perjury that its contents are true and correct. From the University of.

Mechanics liens enable contractors to collect money they earned doing work by encumbering the property they worked on until. Patrol Special Operations Maricopa Countys Most Wanted Print Feedback. IN MARICOPA COUNTY.

Address 550 West Jackson Phoenix Arizona 85003 United States. As permitted by Section 1-506 Filing and Management of Electronic Court Documents of the Code of Judicial Administration electronic filing is permitted as follows in the Superior Court in Maricopa County and shall be governed by Superior Court Administrative Order 2007-140 Arizona Supreme Court Administrative Order 2018-81 and this. In the United States the Indian tribe is a fundamental unit and the constitution grants Congress the right to interact with tribes.

Per Rule 210 of Arizona Court Procedures each attorney shall promptly advise the Clerk of the Superior Court and the Court Administrator separately and in writing of that attorneys office address telephone number e-mail address or law firm affiliation if it is different from that listed in the current Directory of the State Bar of. Tax liens can pay an annual return of 16. Tax liens pay out a flat fee of 10 for the first 6 months or 15 for the second 6 months.

In King County Washington property values increased 9 from 2021 to 2022. The median property tax in Maricopa County Arizona is 1418 per year for a home worth the median value of 238600. 28 1913 warned it is not.

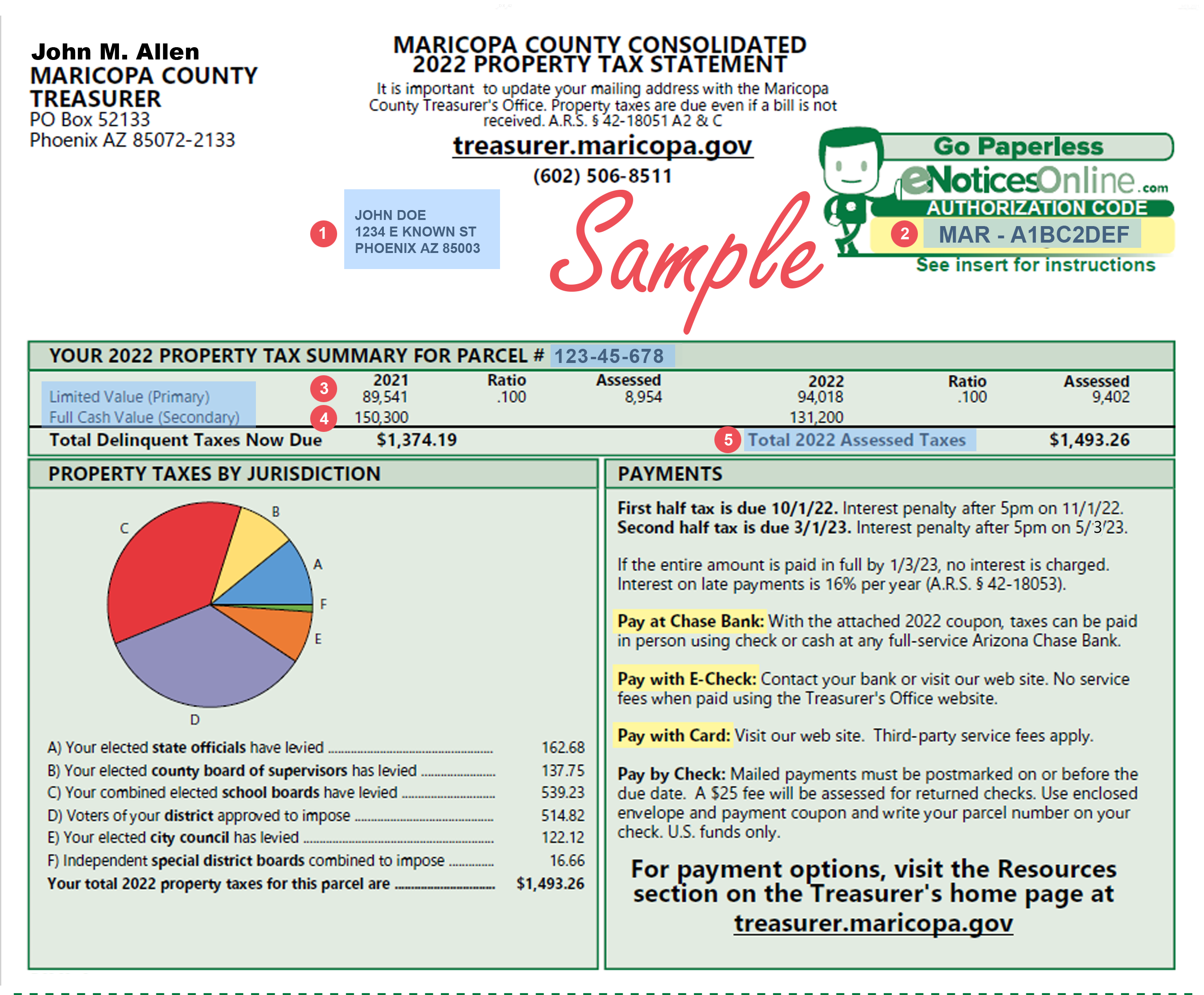

The exact property tax levied depends on the county in Georgia the property is located in. Maricopa County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Maricopa County Arizona. Maricopa County Tax Payments treasurermaricopagov Maricopa County Tax Records.

The Treasurers tax lien auction web site will be available 1252022 for both research and registration. Prior to his election as Recorder Stephen worked as a lawyer and business person. On an annual basis your return could be as high as 120.

Share Bookmark. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer. Home to cities including Phoenix Mesa Chandler Scottsdale Tempe Glendale and many more Maricopa County was the fourth most populated county in the US and attracted more net migration than any other county in the US.

He holds a bachelors degree from Tulane University a masters degree from the University of Chicago and a JD. A lien gives you a right in or over property as security for a debt someone owes you While there are several different types of liens as an individual you probably are filing either a mechanics lien or a judgement lien. Still after 65 years of paying taxes the financial burden can catch up to seniors and become more than they can bear which is why.

Deed and title searches in Maricopa County Arizona. Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102. To claim a property tax credit you must file your claim or extension request by April 15 2020.

Arizona is ranked 874th of the 3143 counties in the United States in order of the median amount of property taxes collected. TITLE to REAL PROPERTY an Adult a Minor deceased. Maricopa County Treasurer Attention Tax Lien Department 301 W.

STATE OF ARIZONA COUNTY OF MARICOPA ss. See Small Claims Property Tax Appeal Forms Page. Form 140PTC provides a tax credit of up to 502.

That Congress may bring a community or body of people within range of this power by arbitrarily calling them an Indian tribe but. If you do not have access to a computer the Treasurers Office will provide public access computers by appointment at designated locations. Some offices including those in Gila County Maricopa County Pima County and Pinal County maintain websites for document searches.

Maricopa County property records. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. AFFIDAVIT for TRANSFER of.

Satisfaction of Judgment and Release of Lien instructions and form - English. The Judicial Branch of Arizona. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022.

Stephen Richer is the 30th Recorder of Maricopa County. Jefferson St Suite 140 Phoenix AZ 85003. Lower Court and Administrative Appeals.

Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the State of Arizona. Update Attorney Information. Between July 2017 and July 2018 Maricopa County added over 81000 people equal to more than 200 people per day.

How high is the potential rate of return on tax lien certificates.

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Displaced In America Housing Loss In Maricopa County Arizona

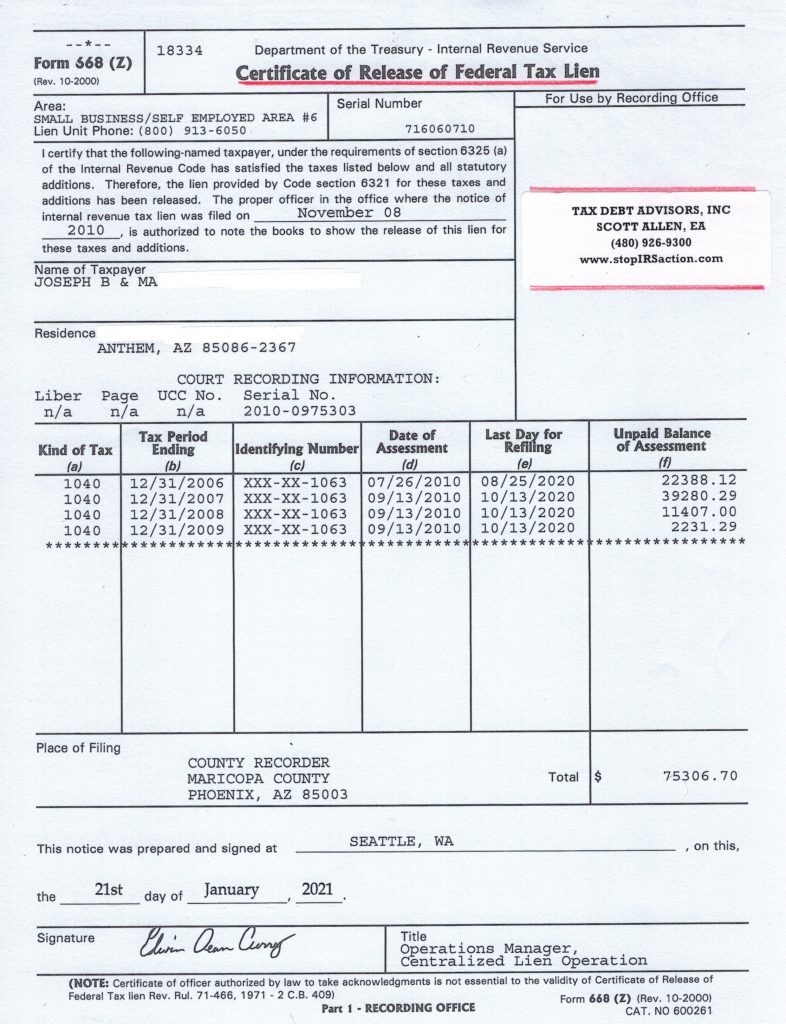

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Maricopa County Island What Is It Arizona Homes Horse Property

Metro Phoenix Evictions These Neighborhoods Hardest Hit In Pandemic

City Limits Maricopa County Az

2022 Elections Battlegrounds To Watch Maricopa County Arizona Politico

Maricopa County Arizona Federal Loan Information Fhlc

Welcome To The Maricopa County Treasurer S Web Page

Maricopa County Board Approved 3b Budget Azbex

Maricopa County Zip Code Map Area Rate Map Zip Code Map Metro Map Map

Pay Your Bills Maricopa County Az

Amazon Com Maricopa County Arizona Zip Codes 48 X 36 Matte Plastic Wall Map Office Products